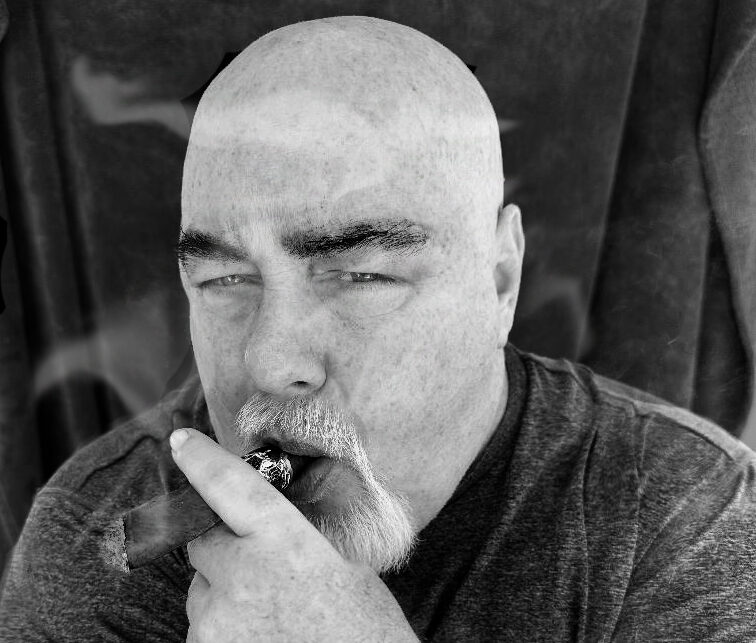

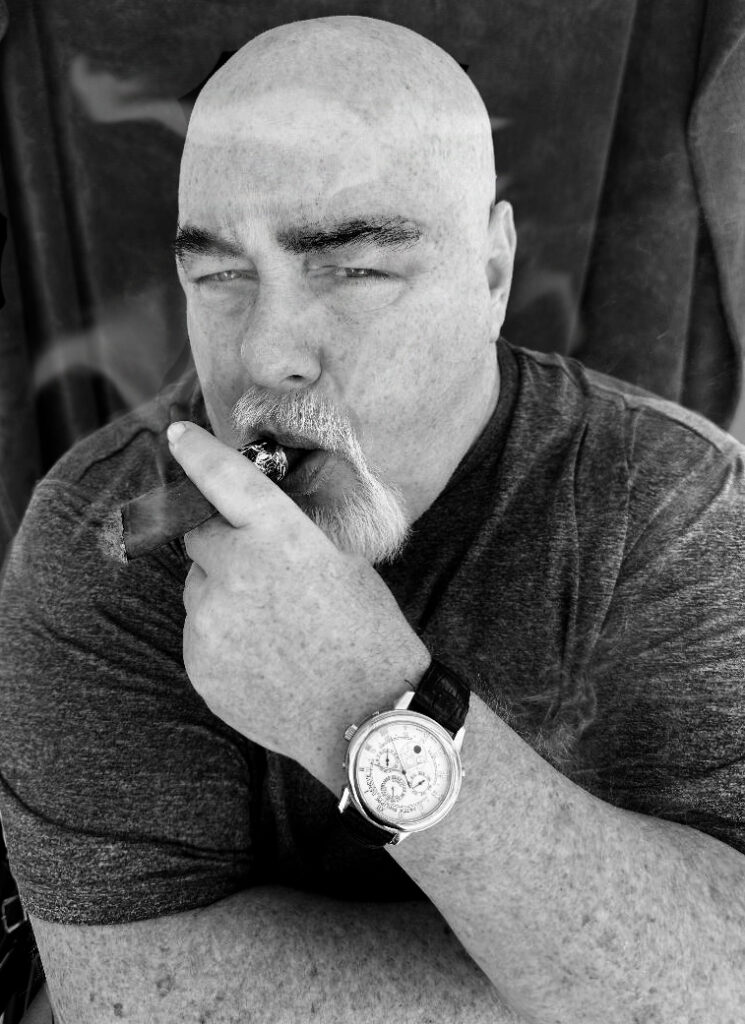

Growing up in the 1980s, a time often described as “the decade of decadence” because of its era of excess and influential cultural icons, self-made billionaire and Chief Executive Officer of Grand Metropolitan, Vin Lee, did not bask in the riches of establishments like Cartier, Tiffany, or a Ferrari showroom. Instead, it was cinema and television that served as the catalyst for his unstoppable drive for success. Films such as Wall Street and Pretty Woman to favored TV shows like Lifestyles of the Rich and Famous, Lee saw a different side of luxury.

Despite his innate passion for the arts and athletics during his youth, Lee harbored no illusions of becoming the next Walt Disney or Olympic swimmer. He knew he was meant to carve his own path, something far superior—Grand Metropolitan. Founded around the same time as major players like LVMH, Richemont, and Kering (Gucci) François Pinault, his Beverly Hills family office has been acquiring distressed debt luxury goods brands for over 30 years, growing their portfolio to become one of the largest privately-held luxury conglomerates in North America. Today, Lee embodies a sophistication and luxury that few can rival, but his focus has always been on the journey of life itself, where true wealth lies in his experiences, relationships, and personal growth. Remaining humble and grounded, Lee diligently works to nurture not only his ventures, but also the futures of his employees.

What inspired you to enter the luxury industry, and how did your early experiences as a young artist shape your approach to entrepreneurship in this sector?

Television and movies. I grew up in the 80s in an affluent community in Michigan, but we didn’t have a Cartier, Tiffany, or Ferrari dealership. From movies like Wall Street, Beverly Hills Cop, and Pretty Woman to television’s Miami Vice and Lifestyles of the Rich and Famous, the world of luxury was brought to a screen near you every day. My billionaire contemporaries like LVMH Bernard Arnault, Richemont Anton Rupert, and Kering (Gucci) François Pinault all started their empires in 1987-1988 when I was just starting my first business. As a teenager, I was tutored by a director from Hanna-Barbera Studios. It was a project that became a feature film and treatment for a Shamu Saturday-morning cartoon underwritten when Anheuser Busch Entertainment purchased Harcourt Brace Jovanovich Park Group, which included Boardwalk and Baseball, Cypress Gardens, and the SeaWorld theme park chain. The film and television projects were created to promote the theme parks, the way Walt Disney used The Wonderful World of Disney to promote Disneyland. I designed merchandise for the 1988 Winter Olympics in Calgary my first year of college in Canada. I also created patents for mechanical billboards that would become a $6 billion-a-year industry and change the landscape of buildings and highways worldwide. By 1990, I was completely immersed in this new luxury economy, driving a Mercedes 560SL and Jaguar XJ6. I signed a deal with the City of Detroit Pension Fund to turn around the fortunes of the $80 million Grand Traverse Resort, where my stake could earn me as much as $50 million over several years. To mark the moment, I went into a DuQuet Jewelers to buy a gold Rolex President. I emerged a few hours later having bought the company, my first foray into luxury. I was 20 years old.

What values or principles do you hold most dear that have guided you in your entrepreneurial journey?

Most of the transactions that have given us significant growth have been on the backs of others’ failures. Dozens of our acquisitions have been companies or brands that have faced bankruptcy proceedings and we have held a white knight position to buy the assets and help save the jobs of the families that built the businesses in the first place. As such, I do not take any risks with my businesses or employees’ futures. We do not borrow money to make deals happen. I pay cash for everything. In addition, I have never taken a dollar out of Grand Metropolitan to fund my lifestyle. Take care of the business and it will take care of you.

Can you share a pivotal moment or decision in your journey with Grand Metropolitan that challenged your beliefs or pushed you out of your comfort zone?

In 2002, I made an attempt to acquire Samuels Jewelers, then the fifth largest jewelry chain the U.S., with $200 million in sales and about 200 locations for $75 million. I put everything on the line to make this deal happen. Two years later, the financing still wasn’t complete. I was $13 million short. I had to decide to waste more time and resources that I didn’t have or walk away and pay the bankers for their time, which would completely empty my bank accounts. My integrity and reputation was more important. I paid the multimillion-dollar bill and had to start over at 31. Less than 30 days later, Samuels would be tossed into bankruptcy and eventually get embroiled in a $2 billion bank fraud with India’s PNB and Nirav Modi. Today, we own Samuels along with 20 of the top 50 retail brands in the industry.

In what ways do you believe Grand Metropolitan is reshaping the traditional landscape of the luxury and jewelry industries, and what future innovations do you envision for the brand?

Much of our efforts the last two decades have been to convert hardcore brick-and-mortar luxury leaders into our digital platform. Long before LVMH’s 24S and Richemont’s YOOX Net-a-Porter, we have been building social media and e-commerce operations built upon our legacy brands. Even amongst our jewelry competitors like Signet Jewelers’ multibillion-dollar investments in Blue Nile, James Allen, and Diamonds Direct, Finlay Fine Jewelers has been wholesale and retail leaders in fine jewelry. In addition, we have completely denied participating in the Fake Diamond (LGD Lab Grown Diamond) efforts of competitors like Signet, Pandora, and DeBeers.

How do you navigate the balance between innovation and tradition in the fashion and luxury

industries?

We don’t chase trends like the Fake Diamond. Luxury is timeless. I created the first diamond tennis earrings, often referred to as the ear climbers in the marketplace. For decades, we have dressed celebrities and high-powered individuals in our fine jewelry, which lead to licensing deals down- stream. Today, you see brands like Chaumet and Messika focusing on diamond earrings with the most elegant profiles.

In what ways do you see yourself as a role model for others, and how do you hope to inspire the next generation of leaders in the luxury industry through your experiences and insights?

My role models were all billionaires and men I had the pleasure of working with, including H. Wayne Huizenga, Sumner Redstone, Phillip Anschutz, etc. In recent years, you see a trend where billionaires have been demonized and successful people are somehow looked down upon, as if being criminal. You hear it out of the mouths of the mainstream media and our politicians. Even with thousands of people creating extraordinary wealth in the tech markets that built today’s world of the internet, we are facing a rejection of the entrepreneurial spirit. Yet, every teenager is at home creating businesses, apps, and trying to become millionaire influencers. I know I get a lot of attitudes from people I grew up with, like it’s a crime to work hard and build a company that employs thousands of families. It wasn’t until I got sick around 2020. I had a heart attack and contracted a bone disease called Charcot that resulted in the loss of the use of my legs. After my amputation, I was fortunate that my business was strong enough to survive my absence, as well as the COVID pandemic. I have heard from many people over the years about my attitude and return to work being an inspiration to those in both the impaired and capable communities.

How do you balance humility with the immense wealth associated with Grand Metropolitan, and what advice do you have for aspiring entrepreneurs looking to make their mark in such competitive markets?

Being a resident of Holmby Hills can have a significant impact on your psyche. Beverly Hills and Bel-Air are renowned for their wealth and affluence on the world market. But Holmby Hills has more $100 million estates than anywhere else on the planet. There have been fewer billionaires on the planet than people who have climbed Mount Everest, arguably one of the most epic of human feats. With billionaire neighbors surrounding you like Elon Musk, Philipp Plein, Petra Ecclestone, Mohamed Hadid, and Richard Saghian, it’s easy to find someone with more money, more jets, more cars, and bigger houses than you. It’s very humbling to see how well the people in this community live. Being resigned to a wheelchair adds a lot of clarity to one’s life. The mansions and fleet of sports cars are worthless now. In fact, the larger the house, the harder and more exhausting it is for me to operate in. And it’s not as much fun sitting in the passenger seat of an exotic car with my wife driving as it was with me behind the wheel. For those starting out, cash is and always will be king. Keep your debt and overhead as small as possible. There are 17-year-olds renting $50,000-a-month mansions and driving Lamborghinis on YouTube and Tik Tok. You don’t have to impress anyone.

What are the top three lessons you’ve learned from your biggest business failures, and how have they shaped your current successes?

I could have taken my first few million dollars and instead of buying a jewelry company, invested it in Apple, Nvidia, or even Monster Energy and have far more than I have today. But that completely misses the point. Life is a zero-sum game at the end. I like to think that I have created a few things that no one has ever seen before, that I have added a little beauty to the world, which in my opinion, is the very heart of what luxury is. I’m certainly not naive to think that I have never made mistakes throughout my career, but 30 years later, every deal I may not have been successful in has come full circle and we own them today. So, the jury is still out on this one. I was unsuccessful in the acquisition of Lord & Taylor, Steuben Glass, and Art Van Furniture, but all three have gone bankrupt.

In your opinion, what personality traits have been most instrumental in your success, and how do you continue to nurture and develop those qualities?

With the early opportunities and success that I had in my teens, I’ve developed a confidence that I can do anything I set out to do. When I look back 40 years ago, I can’t believe the things I was involved in and how they led me down this path. I would have to say that creativity has always been the one trait I have to fall back on in any area of my life.

You may also like

-

Staying Loud, Staying True: Spacey Jane’s Evolution from Perth to the World

-

Reframing Narratives with KATHERINE FLYNN

-

FIGHT TO THE OTHER SIDE: Hilary Roberts on Suffering, Freedom, and Sharing her Mafia Gifts

-

SEXY 4EVER – An Interview with INJI

-

BREAKING BREAD with GAVIN ROSSDALE: A Conversation about Music, Food, and the Art of Hospitality

-

UNCOVERED: The Liberation of MODEL ROZ